hotel tax calculator bc

2 on the balance up to and including 2000000. The rate you will charge depends on different factors see.

Realtymonks One Stop Real Estate Blog Real Estate Marketing Real Estate Easy Loans

For example if your hotel is located in Vancouver which is subject to a 2 MRDT and a 15 destination marketing fee and you provide a room in your hotel for 200 per night your guest.

. 8 rows Income Tax Calculator British Columbia 2021. Type of supply learn about what. BC Revenues from Sales Taxes.

In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations with four or more. 1 This regulation may be cited as the Hotel Room Tax Regulation. 100 per day per room the hotel room.

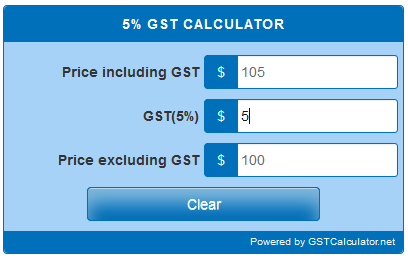

1 on the first 200000. Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings. Useful for figuring out sales taxes if you sell products with tax included.

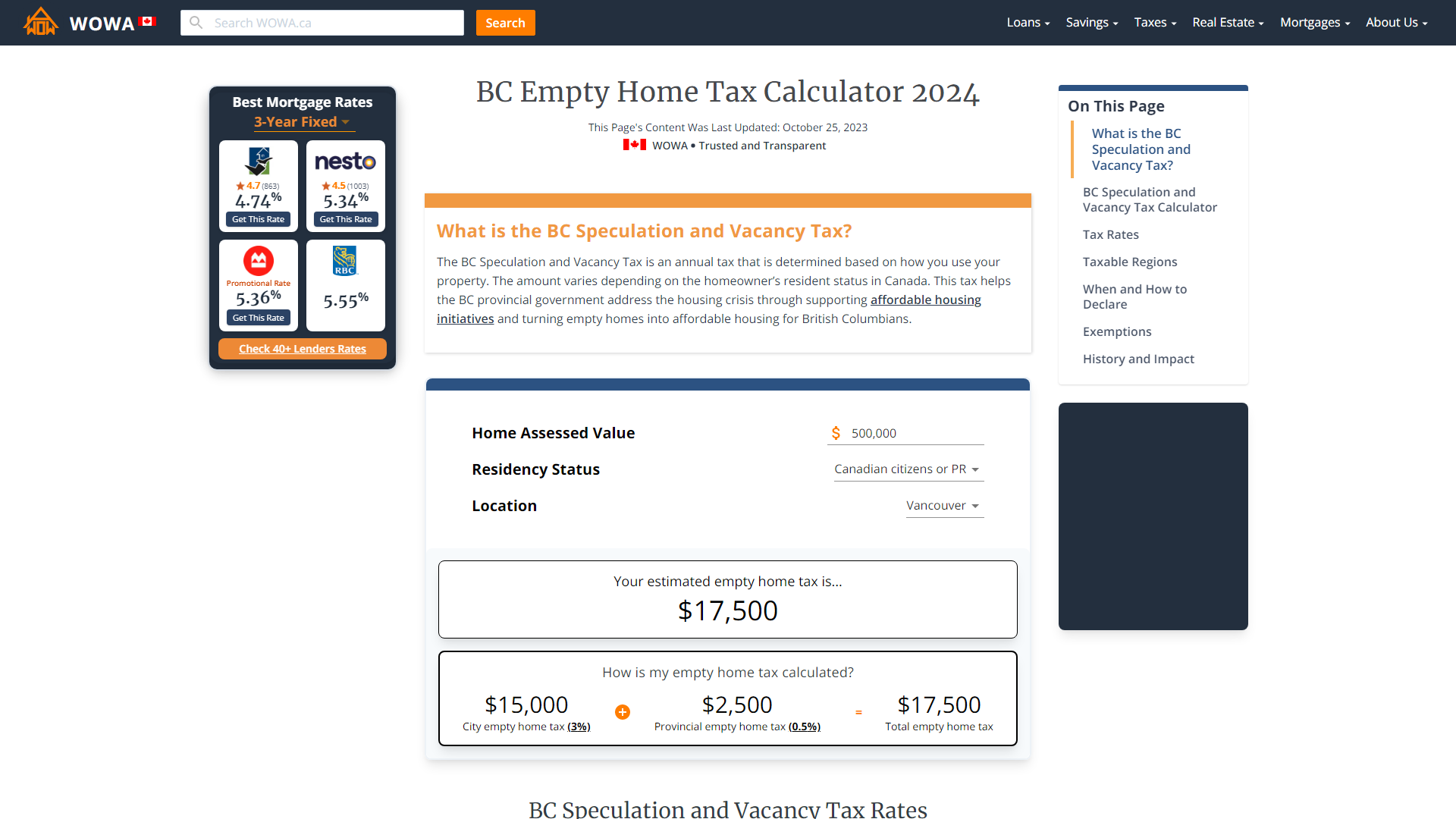

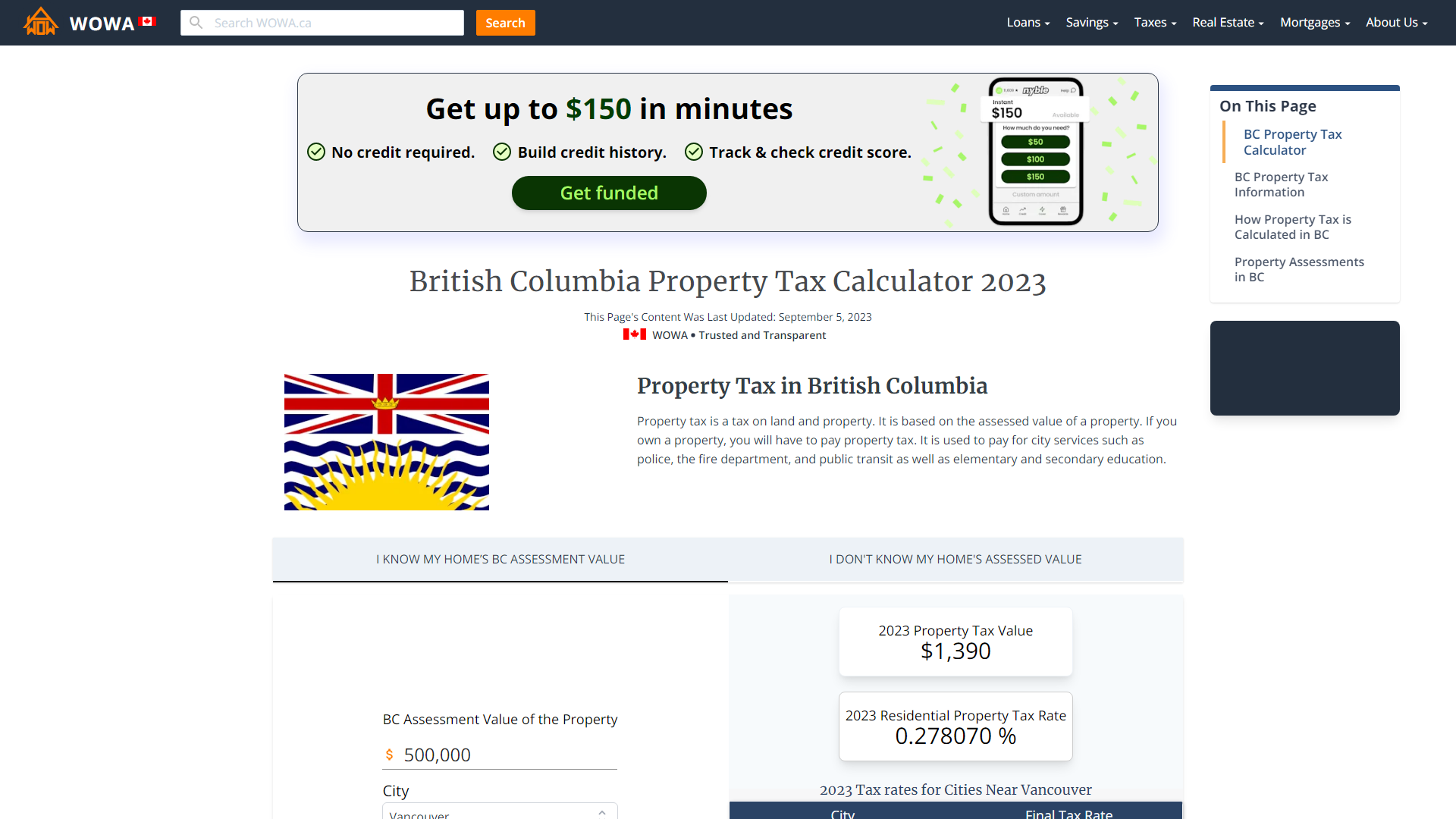

So if the room costs 169 before. Base amount is 11070. BCs Vacancy Tax can be 05 of your homes assessed value annually.

The tax will be. The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association. No hotel tax or levy YUKON No hotel tax or levy BEYOND CANADA NEW YORK STATE New York State legislation plus munic-ipal andor county authorizations to collect taxes on their behalf.

Taxable and Exempt Accommodation Definitions For the purpose of PST and. In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations. A tax rate increase will only take effect after an application has been approved by regulation.

Hotel and accommodation taxes. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill.

Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings. Revenues from sales taxes such as the PST are expected to total 7586 billion or 225 of all. 20 or more but less than 30.

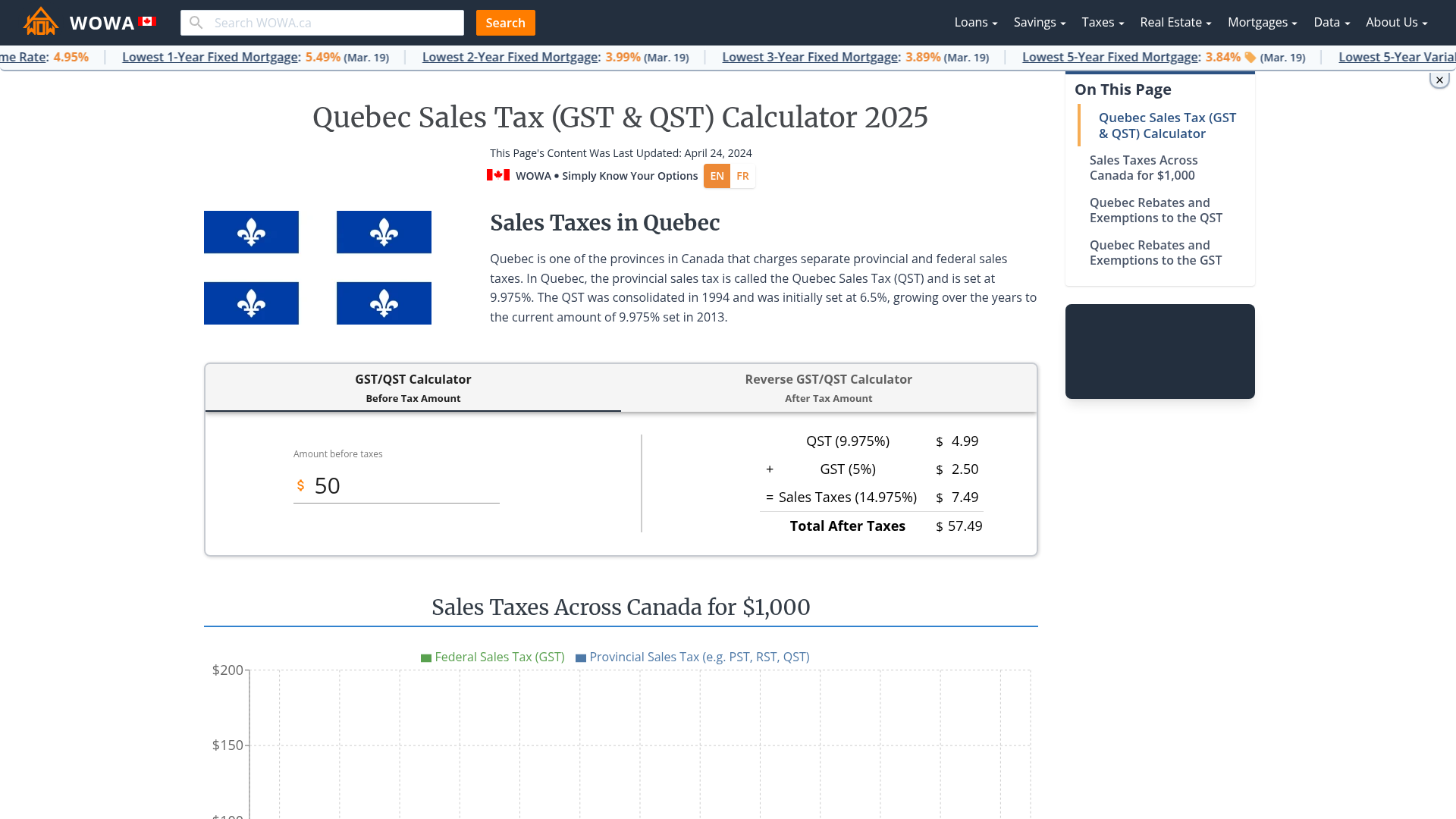

Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. 2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada.

Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax. Hotel Room Rates and Taxes. The information used to make the tax and exemption.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax. Select the appropriate tax rates for the desired service area and property class by clicking on the box to the right.

Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. Applies to major cities in BC. The British Columbia Annual Tax Calculator is updated for the 202021 tax year.

50 cents per day per room the hotel room occupancy tax rate. Current GST and PST rate for British-Columbia in 2021. The following table provides the GST and HST provincial rates since July 1 2010.

In 2021 British Columbia provincial government increased all tax brackets and base amount by 1 and tax rates are the same as previous year. Use our Income tax calculator to quickly. For most residential properties the general property transfer tax calculation is as follows.

Sales taxes make up a significant portion of BCs budget. Current GST and PST rate for British-Columbia in 2019. When all the rates have been selected click on any of the Calculate buttons to.

10 or more but less than 20. 3 on the balance. The instalment payment due dates are.

21 In this regulation unless the context otherwise requires section 1 of the Act shall apply. You can calculate your Annual take home pay based of your Annual gross income and the tax. Since your employer health tax is over 292500 you are required to make quarterly instalment payments.

GST 5 PST 7 on most goods and services. Only In Your State. Calculate your BC Vacancy Tax from your homes assessed value.

It is generally progressive because it is paid by businesses and higher. A hotel and accommodation tax or levy is a specific fee on hotel or motel charges. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada.

Last Weekend I Attended The Vancouver Whitecaps Game As Part Of The North Road Business Improvement Association Where I Sit A Notary Tri Cities Legal Services

Vancouver Real Estate Commission Calculator Realtor Fees Bc 2022

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Mortgage Formula Cheat Sheet Home Loan Math Made Simple Mortgage Loans Mortgage Rates Today Types Of Loans

British Columbia Empty Home Tax Calculator 2022 Wowa Ca

5 Percent Gst Calculator Gstcalculator Net

British Columbia Gst Calculator Gstcalculator Ca

British Columbia Property Tax Rates Calculator Wowa Ca

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

3 Methods To Calculate Your Gst Sharon Perry Associates Cpa

Second Hand New International Tax Advisor Tax Advisor Post Free Ads Advisor

Variance In Excel How To Calculate

Hourly To Salary What Is My Annual Income

How To Calculate Hotel Tax Canada Ictsd Org

We Can Help Anyone Buy A Home Zero Down Or Qualify For A Rent To Own Home We Have Helped Over 13 000 Buy A Rent To Own Homes Rent Rental Property Investment